Some Known Facts About The Best Scalping Technique.

Table of ContentsHow The Best Scalping Technique can Save You Time, Stress, and Money.The Best Scalping Technique Can Be Fun For AnyoneExcitement About The Best Scalping TechniqueIndicators on The Best Scalping Technique You Need To KnowThe Single Strategy To Use For The Best Scalping Technique

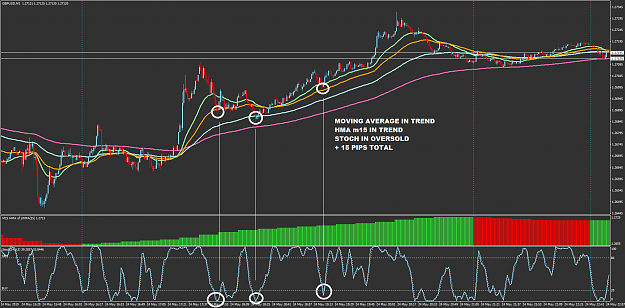

Scalpers seek to benefit from tiny market activities, capitalizing on a ticker tape that never stalls. For years, this fast-fingered day-trading crowd relied upon Level 2 bid/ask displays to find buy and also sell signals, reading supply and need imbalances far from the National Ideal Quote and also Deal (NBBO)the bid/ask rate that the typical person sees. The signals utilized by these real-time devices are similar to those used for longer-term market approaches, but rather, they are applied to two-minute graphes.A prompt departure is called for when the indicator crosses and rolls versus your position after a lucrative thrust. You can time that leave much more exactly by viewing band communication with rate.

Take a timely departure if a price drive falls short to get to the band but Stochastics rolls over, which informs you to obtain out. Once you're comfortable with the process as well as communication in between technical elements, really feel free to change typical variance greater to 4SD or lower to 2SD to account for day-to-day adjustments in volatility.

Finally, bring up a 15-minute graph without any indicators to keep an eye on background conditions that may affect your intraday performance. Include 3 lines: one for the opening print and two for the low and high of the trading array that established in the very first 45 to 90 mins of the session. The Best Scalping Technique.

Our The Best Scalping Technique Statements

Scalpers can no longer depend on real-time market deepness analysis to get the buy and also sell signals they need to book numerous tiny profits in a common trading day.

Many traders gain decent incomes touching right into this volatility. One typical means to go about trading is known as scalping a fast-paced trading strategy that includes making a large number of professions, each resulting in small earnings.

And also they're a lot cooler than Jeff Bezos. As soon as tiny price motions push the asset to the scalp trader's revenue goal, the investor markets the placement as well as actions on to the next.

The 6-Minute Rule for The Best Scalping Technique

Only stocks with high trading quantity are thought about for this technique. Cost activity is key to any type of effective profession, and the scalp-trader desires points to occur rapidly., meaning they are understood for hectic cost variations.

When looking for a solid entrance, the trader uses real-time graphes with a short time structure, making use of tick or one-minute charts to evaluate rate relocations. When scalpers see opportunities, they get in the trades, maintaining their mouses on the "sell" switch, ready to cash out at the first sign of profit.

Traders usually make use of numerous moving standards established to various period and also seek crossovers. When a temporary SMA goes across over a long-lasting SMA, it suggests that the supply is most likely to move upward (The Best Scalping Technique). On the other hand, when the temporary SMA goes across below the long-term SMA, it suggests the stock is likely to relocate downward.

The Best Scalping Technique for Beginners

On a MACD graph, the limits are established at severe highs and also extreme lows, as well as MACD and signal lines between oscillate in between both. Traders try to find crossovers as an indicator of transforming momentum. When the MACD line crosses over the signal line, the signal is favorable. A MACD line that visit crosses below the signal line recommends decreases could be in advance.

Investors use this device under the idea that momentum comes before cost motion. Investors make use of the stochastic oscillator to get signals straight prior to movements take place in the marketplace. The scalp trading approach is amazing but risky. It is very important that scalpers take actions to manage their threats. Right here are a couple of methods you can do to minimize your dangers while following this technique:.

It is necessary not to get hoggish and keep a winning profession long enough for it to turn around and come to be a loss. Examine your feelings at the door before you begin trading. Constantly be ready to act. Changes happen quickly out there, so you can not take your eyes off the sphere.

It's fast-paced, it might lead to significant profits, and it's a fairly straightforward approach to release. As with any various other short-term trading technique, scalp trading comes with a high degree of threat.

The 8-Second Trick For The Best Scalping Technique

Similar to any kind of other trading approach, the scalping strategy comes with its very own checklist of pros and disadvantages that must be thoughtfully considered prior to diving in. There are several advantages to scalping in the supply click resources market. A few of one of the most substantial consist of:. Heading occurs rapidly based exclusively on rate activities, so there's no demand for thorough basic analysis or other daunting research study regarding the possessions you're trading.

If you have the technical evaluation abilities as well as an eager understanding of exactly how the market functions, you could come to be the following significant success. As a hectic approach, scalping requires traders to frequently search for the following chance as well as watch on open professions. Several traders locate it an amazing way to maintain themselves hectic while making cash in the marketplace.

Although there are a lot of reasons to be excited regarding getting going with this trading technique, there are discover here also a few considerable disadvantages to scalping. Traders count on little rate modifications and tiny revenues. That means one poor mistake that results in a large loss could be adequate to erase your entire trading day's profits or even more!.